Leo Laporte [02:12:48]:

Yeah, I, I understand both sides of this. I really do. It’s, you know, it’s problematic. It wouldn’t. It’s. The billionaires wouldn’t suffer. They can afford it. It’s the people who have stock options or stock awards from their companies.

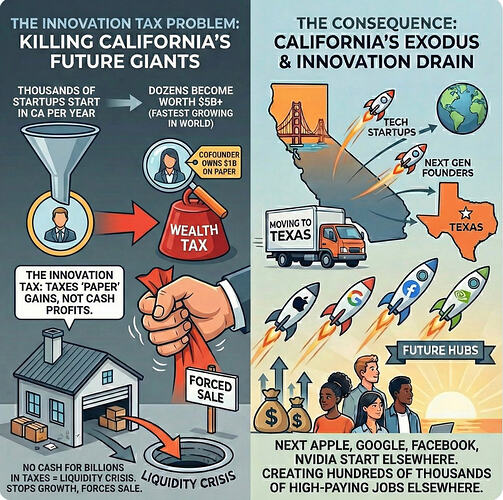

I don’t think Leo has educated himself on this issue. As the Tax Foundation notes:

The 2026 Billionaire Tax Act, a California ballot initiative, would ostensibly impose a one-time tax of 5 percent on the net worth of the state’s billionaires. Due, however, to aggressive design choices and possible drafting errors, the actual rate on taxpayers’ net worth could be dramatically higher. […] The poorly drafted initiative creates many scenarios in which tax liability would be VASTLY MORE than 5 percent of net worth.

And Garry Tan notes:

But because their shares have 10x voting power, the SEIU-UHW California billionaire tax would treat them as owning 30% of Alphabet (3% × 10 = 30%). That means each founder’s taxable wealth would be $1.2 trillion. A 5% wealth tax on $1.2 trillion = $60 billion tax bill, each. That’s 50% of their actual Alphabet holdings—wiped out by a “5%” tax.

Why does the SEIU-UHW think they’re entitled to a freakin’ “Chapter B” multiplier on these assets? Who knows? Nobody anywhere has written an essay why this draconian multiplier makes any sense at all. It just seems mean-spirited. I can’t see how it makes sense to confiscate half the Google holdings of Page and Brin. $60B is a massive amount of tax on each. Moreover, these founders would suffer a tectonic shift in the governance of their companies, since half of their Alphabet holdings would be liquidated.

It also puts a damper on any new startups being created in Silicon Valley – or anywhere in California! Page and Brin and Zuck can eject from CA; new founders would not have that option. The case for establishing new CA startups makes far less sense than it did a year ago.

Leo noted that Jensen Huang isn’t objecting:

Leo Laporte [02:13:13]:

I understand that Jensen Huang has said he has no objection to the tax. Interesting that.

The answer is simple: Huang owns 3-3.5% of NVIDIA shares, and they are not Class B shares. His “tax” would be an actual 5%, instead of the 50% tax of Page and Brin.

Here’s a graphic:

Newsom says he will fight the SEIU tax proposal. He is waaaaay too late: California loses a mind-boggling $1 trillion in wealth in past month alone over fears of ‘Billionaire Tax’: wealth guru. Newsom should have seen this bill coming years ago, and he should have convinced his fellow Californians of the stupidity of this proposal. There’s no way in hell any of those billionaires would even think of returning to California. The WSJ just reported that Mark Zuckerberg Is the Latest California Billionaire to Buy a Florida Home. Oops.

What will be the impact on California? This is the opposite of the chickens coming home to roost: the geese laying the golden eggs have flown the coop and left for good. With each of those billionaires, hundreds of other staffers – well-paid staffers – have also left the state. A massive amount of CA annual tax collections has forever vanished. CA could cut their spending, but they never do that. The only way for a spending-drunk state government to balance its books is to tax everyone else that much more. Leo, Jason, Steve G., TWiT Staffers, and other CA hosts will bear the burden of this terrible proposed legislation, and the state will probably never recover.

Critiques of this destructive law have been circulating for a long time. I’m surprised the team never re-examined the issue. California will miss its billionaires – for many reasons. The SEIU is evil. With their proposal, a small group of individuals have done permanent and irreparable damage to their home state. IMHO, that’s who you should be angry with. ![]()